how much tax is taken out of my first paycheck

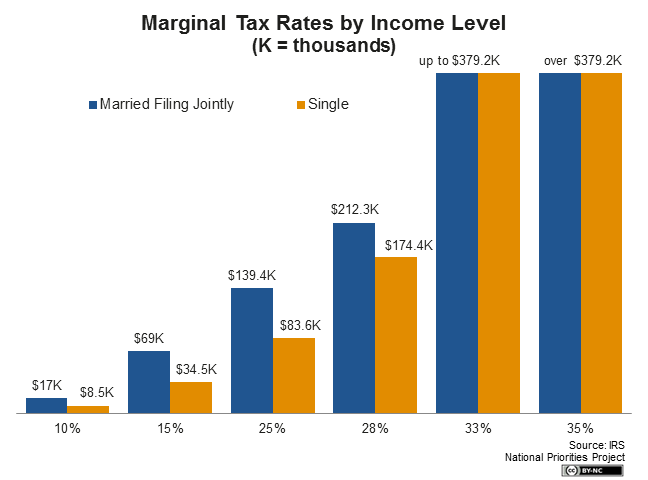

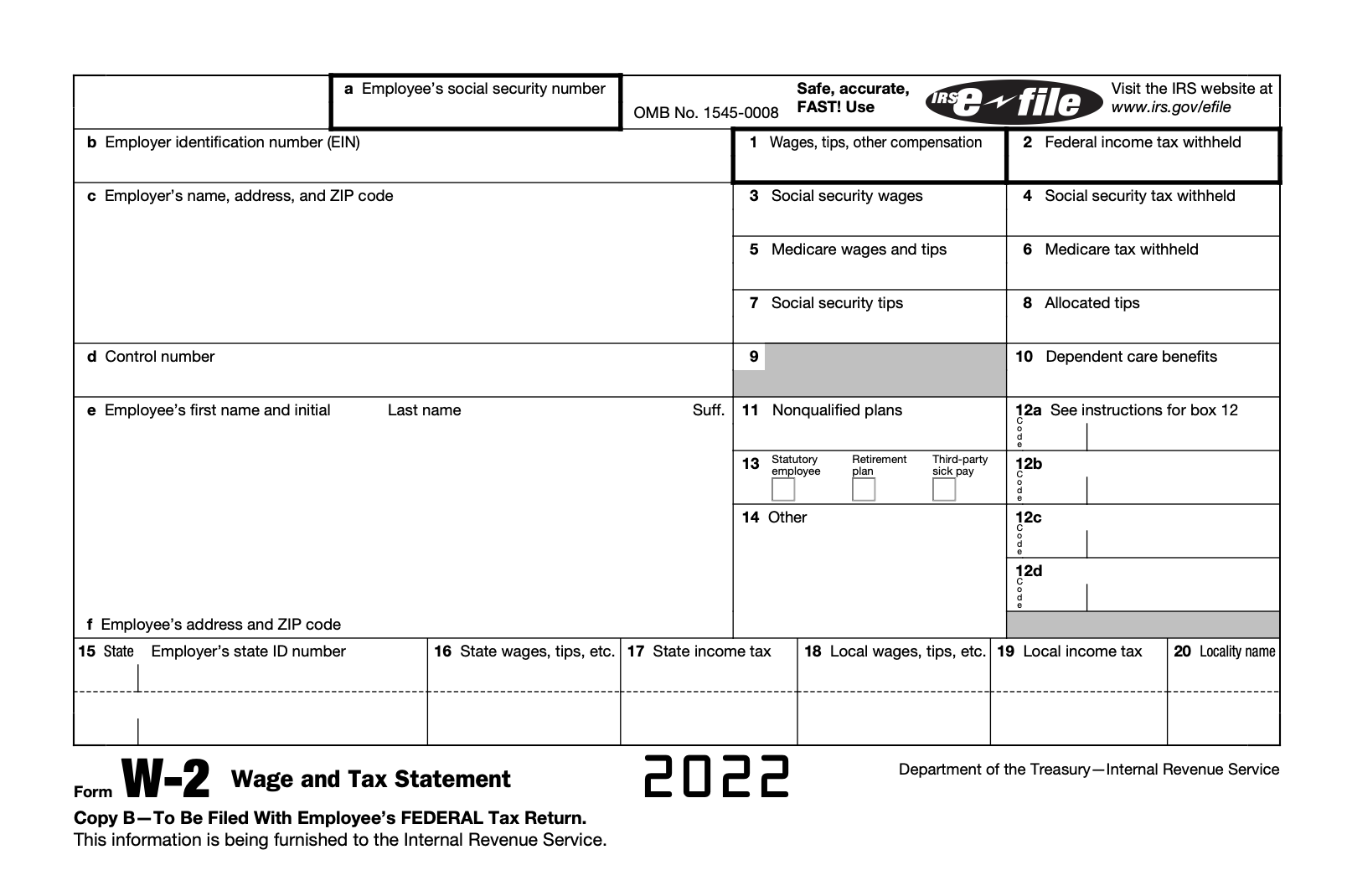

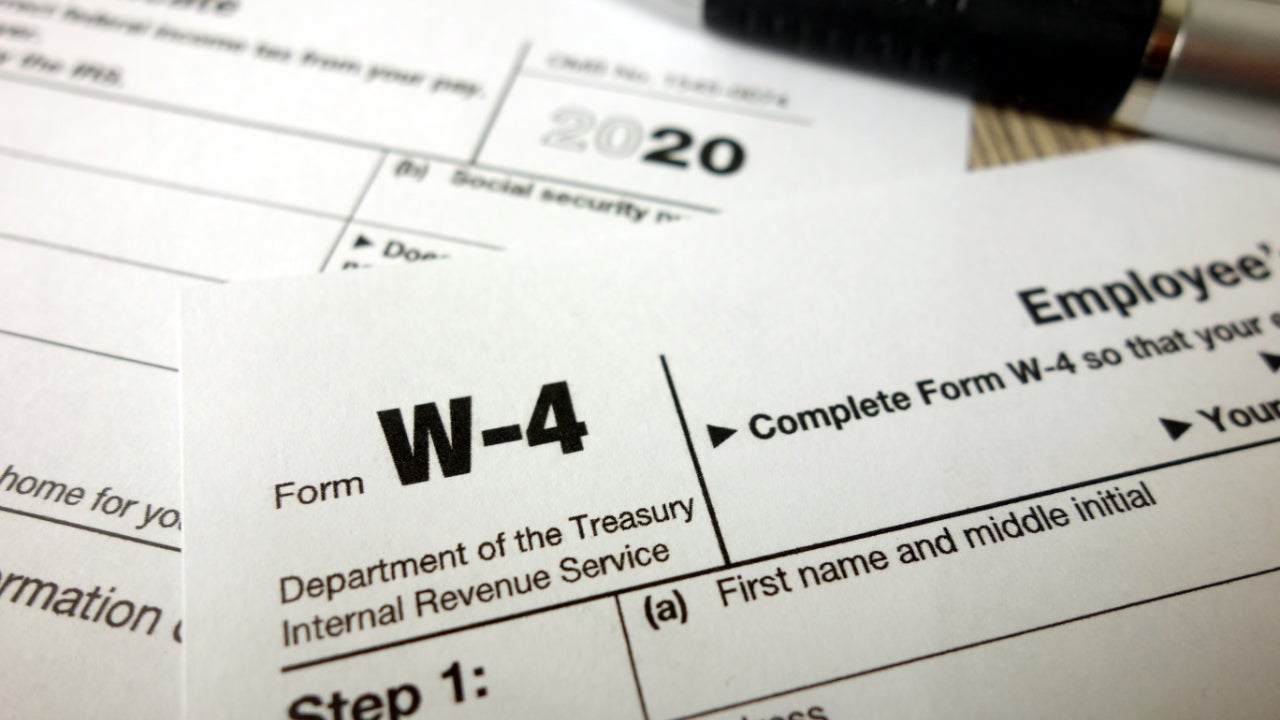

Federal income taxes are paid in tiers. It can also be used to help fill steps 3 and 4 of a W-4 form.

Oregon state income tax rate table for the 2020 2021 filing season has four income tax brackets with OR tax rates of 475 675 875 and 99 for Single Married.

. The state tax year is also 12 months but it differs from state to state. How much tax is taken off a paycheck in Ontario. New Yorks income tax rates.

The irs encourages everyone including those who typically receive large refunds to do a paycheck checkup to make sure they have the right amount of tax taken out of their pay. Use this tool to. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on.

Some states follow the federal tax year some. Thats 70 which is whats left after you deduct 30 That means in the. Wealthier individuals pay higher tax rates than lower-income individuals.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Employers are required to withhold PA personal income tax at a flat rate of 307 percent of compensation. An example of how this works.

How much is payroll tax in PA. When you file your tax return youd. To figure out what the take-home pay would be in that scenario simply multiply the salary times 070.

Estimate your federal income tax withholding. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure. The irs encourages everyone including.

For a single filer the first 9875 you earn is taxed at 10. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. So if your daughter will have a taxable income of 30000 the first 8700 would be taxed at 10 percent and the remaining 21300 would be taxed at 15 percent under the 2012.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. 2 days agoThe first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. 915 on portion of taxable income over 44470 up -to 89482.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Some deductions from your paycheck are made. About Employer Withholding Taxes.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Any of these far-reaching changes could affect refund amounts. See how your refund take-home pay or tax due are affected by withholding amount.

There are eight tax brackets that vary based on income level and filing status. 505 on the first 44470 of taxable income.

What Is Federal Tax Withholding Ramsey

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

Salary Paycheck Calculator Calculate Net Income Adp

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

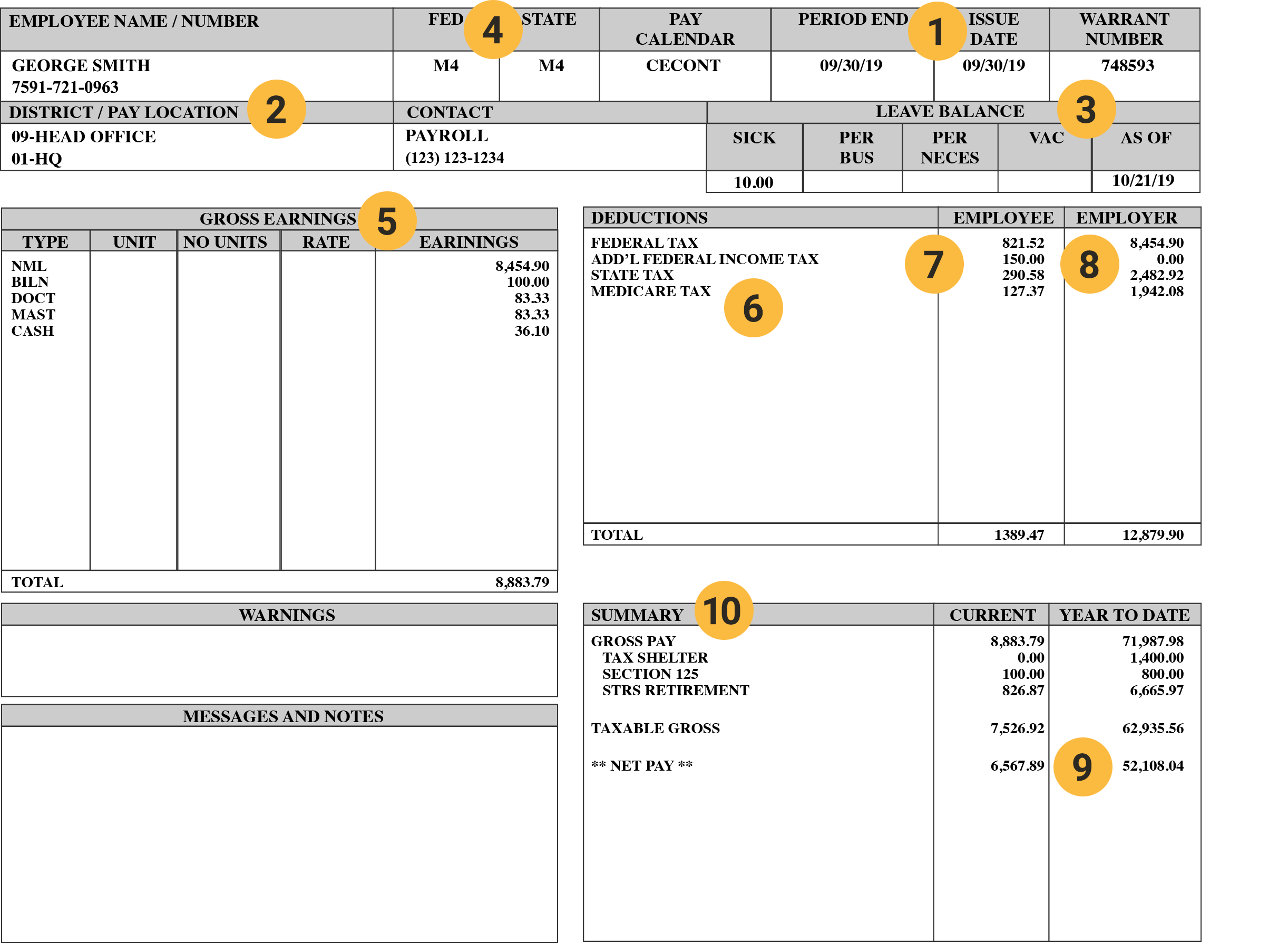

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

New Tax Law Take Home Pay Calculator For 75 000 Salary

Take Home Paycheck Calculator Hourly Salary After Taxes

Take Home Pay What You Can Expect From Your First Entry Level Salaried Job After Taxes And Deductions R Personalfinance

2022 Federal State Payroll Tax Rates For Employers

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

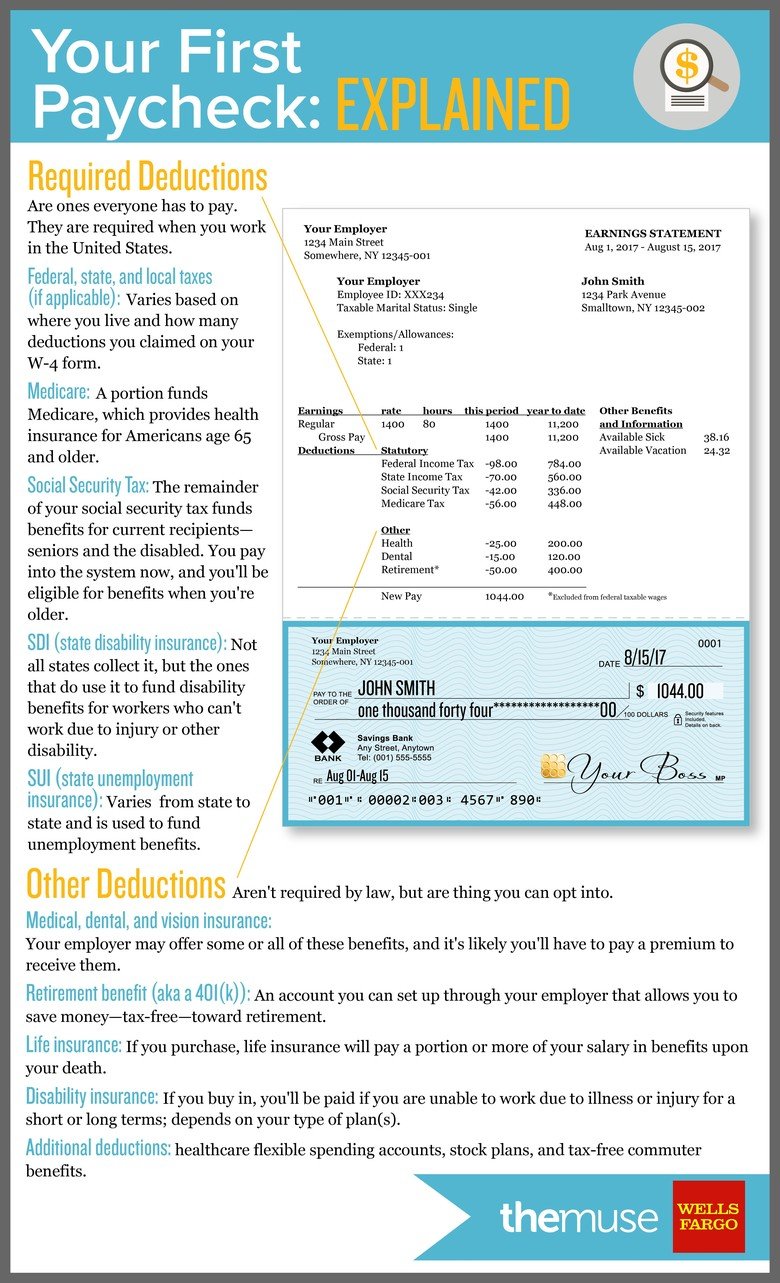

Your First Paycheck Explained The Muse

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Everything Deducted From Your Paycheck Explained Earnest

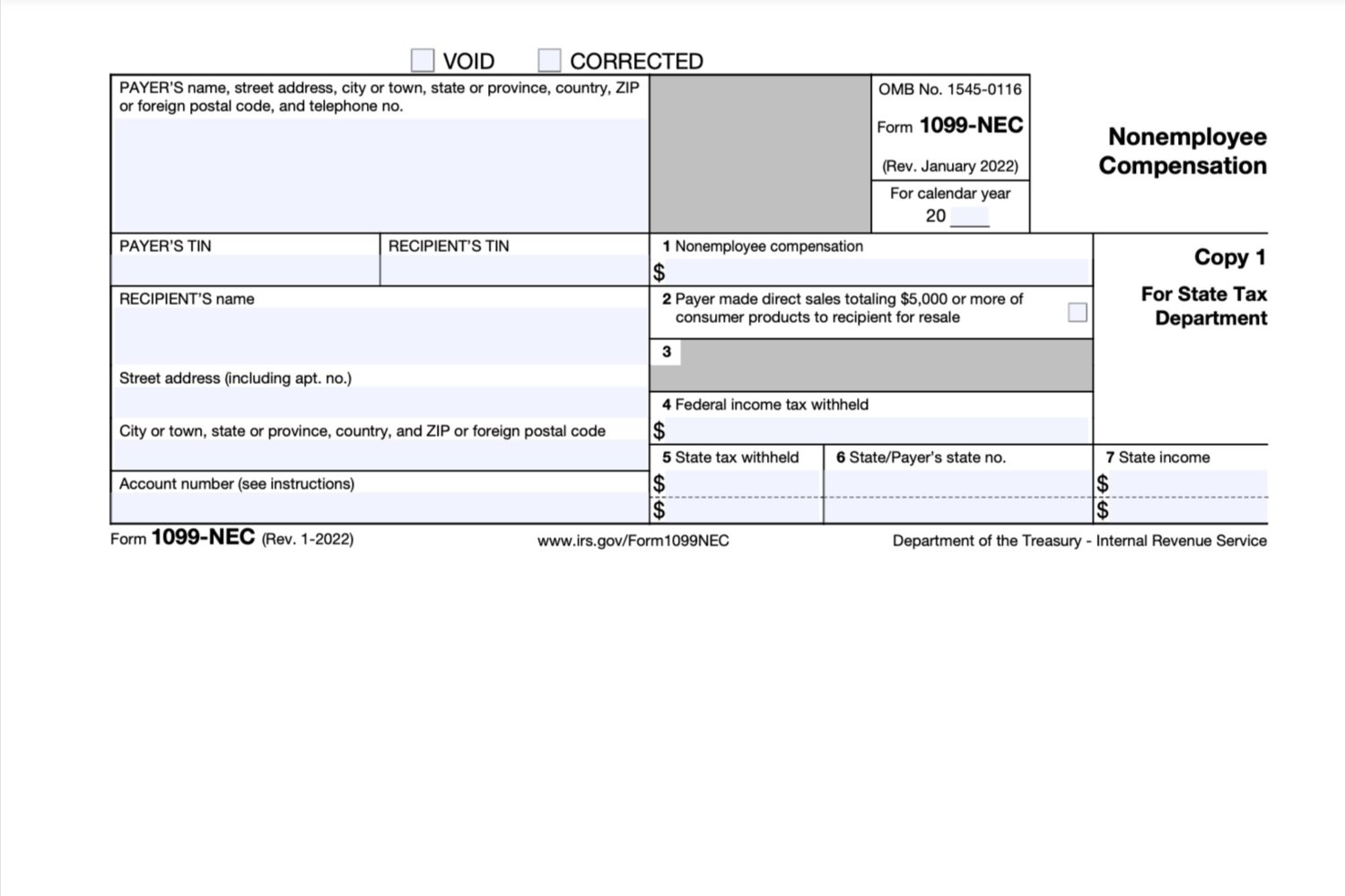

Doordash 1099 Taxes And Write Offs Stride Blog

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate